omaha nebraska sales tax rate 2021

Click here for a larger sales tax map or here for a sales tax table. Form Title Form Document Nebraska Tax Application with Information Guide 022018 20 Form 55 Sales and Use Tax Rate Cards Form 6 Sales and Use Tax Rate Cards Form 65 Sales and Use Tax Rate Cards Form 7 Sales and Use Tax Rate Cards Form 725 Sales and Use Tax Rate Cards Form 75 Sales and Use Tax Rate Cards Form Nebraska Application for.

Sales Taxes In The United States Wikiwand

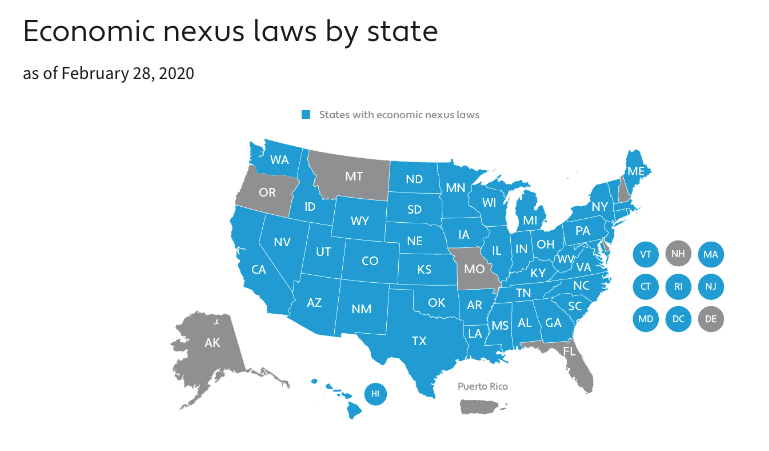

In some cases the local sales tax rate can be higher than the state sales tax rate.

. The Nebraska state sales and use tax rate is 55 055. Plattsmouth NE Sales Tax Rate. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective July 1 2022 Updated 03032022 There are no changes to local sales and use tax rates that are effective July 1 2022.

Read The World-Heralds coverage of the run-up to the 2022 gubernatorial primary With just. So when youre comparing sales tax rates from state to state look at both the combined state and local sales tax. The latest sales tax rates for cities in Nebraska NE state.

Georgia has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 4There are a total of 477 local tax jurisdictions across the state collecting an average local tax of 3683. 2020 rates included for use while preparing your income tax deduction. Click here for a larger sales tax map or here for a sales tax table.

Rates include state county and city taxes. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective April 1. Stay up-to-date on the latest in local and national government and political topics with our newsletter.

Arkansas has state sales tax of 65 and allows local governments to collect a local option sales tax of up to 55There are a total of 397 local tax jurisdictions across the state collecting an average local tax of 2636. Omaha NE Sales Tax Rate. Nebraska voter registration data shows that between December 2020 and February 2021 Republicans decreased by about 2200 voters and Democrats were down about 500 while Libertarians gained 312.

Nebraska has recent rate changes Thu Jul 01 2021. According to the Tax Foundation the five states with the highest average combined state and local sales tax rates are. Papillion NE Sales Tax Rate.

Combined with the state sales tax the highest sales tax rate in Arkansas is 12625 in the city. Combined with the state sales tax the highest sales tax rate in Georgia is 9 in the cities of.

New Ag Census Shows Disparities In Property Taxes By State

Amazon Sales Tax For Sellers In 2021

Nebraska Sales Tax Small Business Guide Truic

Sales Taxes In The United States Wikiwand

Taxes And Spending In Nebraska

Sales Taxes In The United States Wikiwand

How High Are Cell Phone Taxes In Your State Tax Foundation

Compared To Rivals Nebraska Takes More From Taxpayers

Which Cities And States Have The Highest Sales Tax Rates Taxjar

Item Price 29 99 Tax Rate 6 25 Sales Tax Calculator

Get The Facts About Nebraska S High Tax Burden

Sales Taxes In The United States Wikiwand

Should You Move To A State With No Income Tax Forbes Advisor

Nebraska Sales Tax Rates By City County 2022

Cell Phone Tax Wireless Taxes Fees Tax Foundation

Taxes And Spending In Nebraska